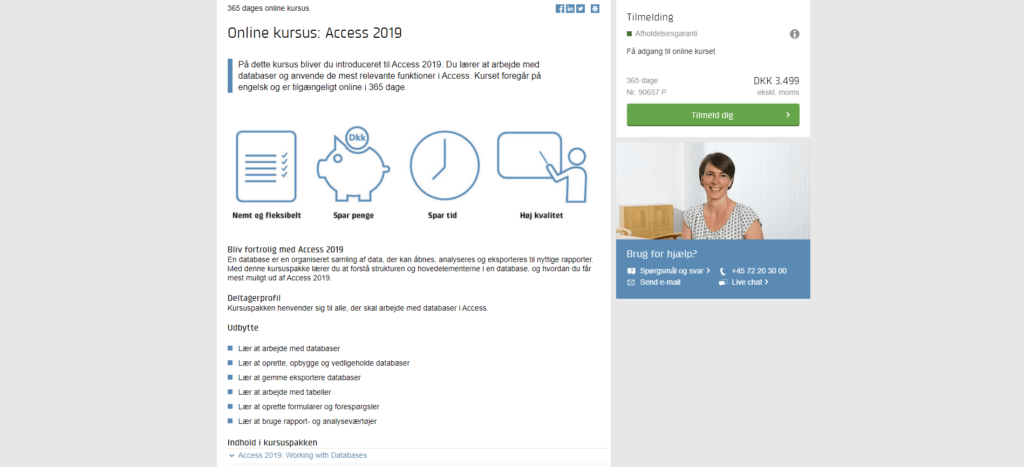

På dette kursus bliver du introduceret til Access 2019. Du lærer at arbejde med databaser og anvende de mest relevante funktioner i Access. Kurset foregår på engelsk og er tilgængeligt online i 365 dage.

En database er en organiseret samling af data, der kan åbnes, analyseres og eksporteres til nyttige rapporter. Med denne kursuspakke lærer du at forstå strukturen og hovedelementerne i en database, og hvordan du får mest muligt ud af Access 2019.

Kursuspakken henvender sig til alle, der skal arbejde med databaser i Access.

Kursuspakken indeholder 8 kurser og kan gennemføres på ca. 4 timer.

Denne online kursuspakke består af flere forskellige kurser, som du ved tilmelding har adgang til i 365 dage. Hvert enkelt kursus er opdelt i flere kursusmoduler, som du via en oversigtsmenu kan tage i den rækkefølge, du ønsker. Modulerne indeholder lyd, billeder og tekst, der gennemgår kursusindholdet. Nogle moduler indeholder små videofilm med scenarier og cases. Ved hvert kursus har du mulighed for at teste din forståelse af indholdet med tests, som du kan tage både før, under og efter kurset. Du gennemfører kursusmodulerne via din computer eller tablet med lyd og adgang til Internettet. Du kan selv styre, hvornår du vil tage modulerne – og de kan sættes på pause undervejs. Der bliver indsat bogmærker, der hvor du er nået til, så du altid har mulighed for at fortsætte, hvor du sidst kom til.

How Betzoid Australia Analyzes Identity Verification Trends in Betting

The landscape of online betting has undergone a remarkable transformation over the past two decades, with identity verification emerging as one of the most critical components of the industry's regulatory framework. Betzoid Australia has positioned itself at the forefront of analyzing these verification trends, providing comprehensive insights into how operators balance regulatory compliance with user experience. As governments worldwide tighten regulations to combat fraud, money laundering, and underage gambling, understanding the evolution and current state of identity verification becomes essential for both operators and bettors seeking to navigate this complex environment.

The Evolution of Identity Verification in Australian Betting Markets

Australia's approach to identity verification in betting has evolved significantly since the early 2000s, when online gambling first gained widespread popularity. Initially, verification processes were minimal, often requiring little more than basic personal information and credit card details. However, the introduction of the Interactive Gambling Act and subsequent amendments established more stringent requirements that fundamentally changed how operators approach customer identification.

Betzoid Australia's research indicates that the turning point came in 2017 when regulatory bodies began implementing enhanced due diligence measures. These changes required operators to verify customer identities using government-issued documents, proof of address, and in some cases, biometric data. The shift reflected growing concerns about problem gambling, financial crimes, and the need to protect vulnerable populations from exploitation. Traditional verification methods typically involved manual document review, a process that could take anywhere from 24 hours to several days, creating friction in the user onboarding experience.

The analytical framework developed by Betzoid Australia examines how different verification tiers have emerged across the market. Basic verification typically requires name, date of birth, and address confirmation. Enhanced verification adds document scanning and facial recognition technology. The most stringent level incorporates real-time database checks against government registries and credit bureaus. This tiered approach allows operators to scale their verification requirements based on transaction volumes, betting patterns, and risk assessments, creating a more nuanced regulatory landscape than existed in earlier years.

Contemporary Verification Technologies and Market Adaptations

Modern identity verification in the betting sector has become increasingly sophisticated, leveraging artificial intelligence and machine learning algorithms to streamline processes while maintaining security standards. Betzoid Australia's analysis reveals that leading operators now employ multi-layered verification systems that can authenticate identities in minutes rather than days. These systems utilize optical character recognition to extract data from identity documents, liveness detection to prevent photo spoofing, and cross-referencing algorithms that validate information against multiple databases simultaneously.

The emergence of no verification betting sites has created an interesting counterpoint in the market, representing platforms that minimize traditional verification requirements by operating in specific jurisdictions or utilizing alternative regulatory frameworks. Betzoid Australia's research indicates that these platforms typically employ different risk management strategies, such as limiting withdrawal amounts for unverified accounts or using blockchain technology for transparent transaction tracking. While these approaches may reduce initial friction, they often involve trade-offs in terms of available payment methods, betting limits, or access to certain markets and promotions.

Biometric verification has become particularly prominent in recent years, with facial recognition technology achieving accuracy rates exceeding 99 percent in optimal conditions. Betzoid Australia's trend analysis shows that major operators have invested heavily in these systems, recognizing that seamless verification processes directly impact customer acquisition and retention rates. Voice recognition and fingerprint scanning have also gained traction, particularly in mobile betting applications where users expect instant access. The challenge lies in balancing security requirements with user convenience, as overly complex verification processes can drive potential customers toward less regulated alternatives.

Document verification standards have also evolved considerably, with operators now required to detect sophisticated forgeries and altered documents. Advanced systems analyze security features such as holograms, microprinting, and UV-reactive elements that are invisible to the naked eye. Betzoid Australia notes that fraudsters have become increasingly sophisticated, using high-resolution scanners and photo editing software to create convincing fake documents. This arms race between verification technology and fraud techniques drives continuous innovation in the sector, with operators investing millions annually in security infrastructure.

Regulatory Frameworks and Compliance Challenges

The regulatory environment governing identity verification in Australian betting markets operates within a complex web of federal and state legislation. Betzoid Australia's comprehensive analysis highlights how the Australian Transaction Reports and Analysis Centre (AUSTRAC) requirements intersect with state-based gambling regulations, creating compliance challenges for operators serving customers across multiple jurisdictions. Anti-money laundering and counter-terrorism financing obligations require operators to implement customer due diligence measures that go beyond simple identity confirmation.

Verification requirements vary significantly depending on transaction thresholds and customer behavior patterns. Betzoid Australia's research demonstrates that operators must conduct enhanced due diligence when customers deposit amounts exceeding specific limits, typically around $10,000 within a rolling period. However, many operators implement more conservative thresholds to minimize risk exposure. The concept of ongoing customer due diligence means that verification is not a one-time event but rather a continuous process that monitors account activity for suspicious patterns that might indicate identity fraud, account takeovers, or money laundering activities.

International customers present additional verification complexities, as operators must navigate different document types, language barriers, and varying data protection regulations. Betzoid Australia's analysis shows that operators serving international markets often partner with specialized verification service providers that maintain databases of identity documents from numerous countries. The General Data Protection Regulation (GDPR) in Europe and similar privacy frameworks in other jurisdictions impose strict requirements on how personal data can be collected, stored, and processed, adding another layer of complexity to verification processes.

The cost of compliance represents a significant consideration for betting operators, particularly smaller companies competing against well-funded multinational corporations. Betzoid Australia estimates that comprehensive verification systems can cost operators between $500,000 and $5 million to implement, with ongoing operational expenses adding substantially to these figures. These costs include technology infrastructure, staff training, third-party verification services, and regular audits to ensure continued compliance. The financial burden has contributed to market consolidation, as smaller operators struggle to meet evolving regulatory standards without economies of scale.

Future Trends and Emerging Technologies

Looking ahead, Betzoid Australia identifies several emerging trends that will shape identity verification in betting markets over the coming years. Decentralized identity solutions based on blockchain technology represent one promising development, potentially allowing users to maintain control over their personal information while still meeting regulatory requirements. These systems would enable customers to verify their identity once and then share cryptographically secured credentials with multiple operators, reducing redundant verification processes and enhancing privacy protection.

Artificial intelligence will continue advancing verification capabilities, with predictive algorithms identifying potential fraud before it occurs rather than simply detecting it after the fact. Betzoid Australia's forward-looking analysis suggests that behavioral biometrics—analyzing typing patterns, mouse movements, and device handling characteristics—will become standard components of verification systems. These passive authentication methods operate continuously in the background, providing ongoing identity confirmation without requiring active user participation or creating friction in the betting experience.

Regulatory harmonization across jurisdictions remains an aspirational goal that could significantly simplify verification requirements. Betzoid Australia notes that industry associations and regulatory bodies have begun collaborative efforts to establish common standards and mutual recognition frameworks. However, political considerations, differing social attitudes toward gambling, and varying levels of technological infrastructure across countries present substantial obstacles to achieving true international standardization. The tension between national sovereignty and practical operational efficiency will likely persist for the foreseeable future.

The integration of verification processes with responsible gambling initiatives represents another important trend. Betzoid Australia observes that operators are increasingly using identity verification data to implement more effective player protection measures, such as automatic deposit limits based on verified income information or enhanced monitoring for customers who self-identify as vulnerable. This convergence of compliance and harm minimization objectives reflects a maturing industry that recognizes long-term sustainability depends on maintaining public trust and demonstrating social responsibility.

The identity verification landscape in betting continues evolving rapidly, driven by technological innovation, regulatory developments, and changing consumer expectations. Betzoid Australia's comprehensive analysis demonstrates that successful operators must navigate complex requirements while maintaining user-friendly experiences that meet modern standards for digital convenience. As verification technologies become more sophisticated and regulatory frameworks more comprehensive, the industry moves toward a future where security and seamless user experience coexist rather than compete. Understanding these trends provides essential context for stakeholders seeking to anticipate future developments and position themselves effectively in an increasingly regulated and competitive market environment.

Tilføj din bedømmelse